All Categories

Featured

Table of Contents

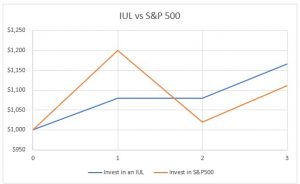

For making a limited amount of the index's growth, the IUL will never ever obtain less than 0 percent passion. Even if the S&P 500 decreases 20 percent from one year to the following, your IUL will not lose any kind of money worth as a result of the market's losses.

Talk regarding having your cake and eating it as well! Picture the interest compounding on a product with that kind of power. So, offered all of this details, isn't it conceivable that indexed global life is a product that would certainly allow Americans to buy term and spend the remainder? It would certainly be tough to refute the logic, would not it? Currently, don't get me incorrect.

A real financial investment is a securities product that goes through market losses. You are never subject to market losses with IUL merely because you are never ever based on market gains either. With IUL, you are not bought the marketplace, however just earning interest based on the performance of the marketplace.

Returns can grow as long as you remain to pay or keep a balance. Compare life insurance policy online in minutes with Everyday Life Insurance Policy. There are 2 kinds of life insurance coverage: irreversible life and term life. Term life insurance only lasts for a specific duration, while irreversible life insurance policy never runs out and has a cash value element along with the fatality benefit.

Maximum Funded Tax Advantaged Life Insurance

Unlike global life insurance, indexed global life insurance coverage's cash money worth makes passion based on the performance of indexed supply markets and bonds, such as S&P and Nasdaq., states an indexed universal life policy is like an indexed annuity that feels like global life.

Universal life insurance coverage was produced in the 1980s when rate of interest prices were high. Like various other kinds of irreversible life insurance policy, this plan has a cash value.

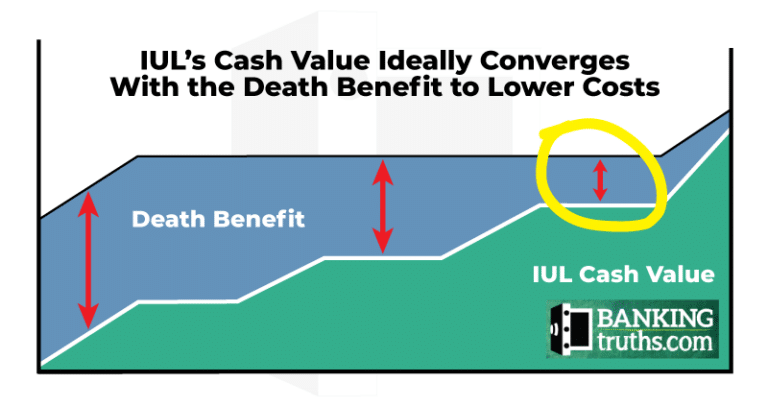

Indexed global life policies offer a minimum surefire rates of interest, also referred to as a rate of interest attributing flooring, which minimizes market losses. Claim your cash money worth sheds 8%. Lots of firms provide a flooring of 0%, meaning you will not lose 8% of your financial investment in this case (best indexed universal life insurance policies). Be mindful that your cash worth can decrease even with a flooring due to premiums and various other costs.

Indexed Universal Life Insurance Companies

It's also best for those going to think additional danger for greater returns. A IUL is a permanent life insurance policy that borrows from the residential properties of a global life insurance policy plan. Like global life, it enables versatility in your survivor benefit and costs settlements. Unlike universal life, your money worth grows based upon the performance of market indexes such as the S&P 500 or Nasdaq.

Her job has actually been published in AARP, CNN Underscored, Forbes, Ton Of Money, PolicyGenius, and United State News & World Report. ExperienceAlani has examined life insurance policy and pet insurance provider and has actually composed many explainers on traveling insurance, credit score, financial debt, and home insurance policy. She is enthusiastic about demystifying the intricacies of insurance policy and various other individual financing topics to ensure that readers have the details they need to make the very best cash choices.

Paying only the Age 90 No-Lapse Premiums will assure the survivor benefit to the insured's achieved age 90 but will certainly not ensure money value accumulation. If your client discontinues paying the no-lapse warranty costs, the no-lapse function will end prior to the guaranteed period. If this happens, additional costs in an amount equivalent to the deficiency can be paid to bring the no-lapse feature back active.

I recently had a life insurance policy sales person appear in the remarks string of a blog post I released years ago about not mixing insurance and investing. He believed Indexed Universal Life Insurance (IUL) was the most effective point considering that cut bread. On behalf of his setting, he posted a web link to a post composed in 2012 by Insurance Policy Agent Allen Koreis in 2012, qualified "16 Reasons that Accountants Prefer Indexed Universal Life Insurance Policy" [web link no longer offered]

Guaranteed Universal Life Insurance Definition

First a brief explanation of Indexed Universal Life Insurance Policy. The attraction of IUL is evident. The premise is that you (practically) get the returns of the equity market, with no danger of shedding cash. Now, before you diminish your chair chuckling at the absurdity of that statement, you require to understand they make an extremely convincing disagreement, at the very least up until you take a look at the information and recognize you do not get anywhere near the returns of the equity market, and you're paying much too much for the warranties you're obtaining.

If the market decreases, you obtain the ensured return, normally something between 0 and 3%. Of training course, since it's an insurance plan, there are also the common expenses of insurance policy, payments, and abandonment costs to pay. The details, and the factors that returns are so terrible when blending insurance coverage and investing in this particular means, come down to essentially 3 things: They only pay you for the return of the index, and not the returns.

Index Insurance Definition

If you cap is 10%, and the return of the S&P 500 index fund is 30% (like last year), you obtain 10%, not 30%. If the Index Fund goes up 12%, and 2% of that is rewards, the modification in the index is 10%.

Add all these effects with each other, and you'll locate that long-term returns on index global life are pretty darn close to those for entire life insurance coverage, favorable, yet low. Yes, these policies assure that the cash money value (not the money that goes to the costs of insurance policy, of training course) will certainly not shed cash, but there is no guarantee it will certainly stay on par with rising cost of living, a lot less grow at the price you require it to grow at in order to offer your retired life.

Koreis's 16 reasons: An indexed global life plan account worth can never ever lose cash due to a down market. Indexed universal life insurance guarantees your account value, securing in gains from each year, called an annual reset.

IUL account values expand tax-deferred like a certified plan (Individual retirement account and 401(k)); mutual funds don't unless they are held within a qualified strategy. Just put, this suggests that your account value advantages from triple compounding: You make rate of interest on your principal, you earn passion on your passion and you gain interest on the money you would certainly or else have actually paid in tax obligations on the rate of interest.

Universal Benefits Insurance

Although certified plans are a far better option than non-qualified plans, they still have issues not provide with an IUL. Investment selections are typically restricted to mutual funds where your account worth goes through wild volatility from direct exposure to market danger. There is a large difference between a tax-deferred pension and an IUL, yet Mr.

You purchase one with pre-tax dollars, saving on this year's tax obligation expense at your minimal tax obligation price (and will typically have the ability to withdraw your money at a reduced effective rate later on) while you purchase the other with after-tax dollars and will be compelled to pay passion to obtain your very own cash if you don't intend to surrender the policy.

Then he includes the classic IUL salesperson scare method of "wild volatility." If you despise volatility, there are much better means to decrease it than by getting an IUL, like diversity, bonds or low-beta stocks. There are no restrictions on the quantity that might be contributed annually to an IUL.

That's reassuring. Let's assume about this for a second. Why would certainly the government placed limitations on exactly how much you can put into pension? Possibly, simply maybe, it's due to the fact that they're such a wonderful deal that the government does not want you to conserve excessive on tax obligations. Nah, that could not be it.

Latest Posts

Indexed Universal Life Leads

Universal Life Insurance For Retirement Income

Universal Life Interest Rates